Stocks vs. real estate: Which investment should you choose?

Should we invest in the stock market or the real estate market? This is a perennial question for investors, economists, and finance students alike. In this paper, we’ll analyze the pros and cons of both types of investments, examine historical returns, and evaluate the risks involved. This detailed analysis will provide valuable insights for researchers, students, investors, and financial professionals.

Stock market or real estate market?

Which investment should you choose?The stock market has been a cornerstone of investment portfolios for over a century. Historical data, such as the Dimson Marsh Staun data from the Global Returns Yearbook, show long-term average returns of inflation plus 5% (6.5% for the U.S. and 4.3% for the world excluding the U.S., 1900-2023). Equity investments are known for their liquidity, low transaction costs and easy diversification through global equity funds. In contrast, the real estate market, particularly residential buy-to-let, offers a tangible investment opportunity. Real estate investments generate steady rental income and can act as an inflation-linked bond. The appeal of the real estate market lies in its physical nature and the ability to leverage investments, although it comes with higher maintenance costs and illiquidity.

When evaluating the stock market as an investment option, it is important to understand both its advantages and disadvantages. This balanced view will help you make informed investment decisions.

| Advantages of Stock Market Investments | Disadvantages of Stock Market Investments |

|---|---|

| 1. Long-term returns: Stocks have consistently outperformed inflation, providing robust long-term returns. | 1. Volatility: The stock market is prone to significant price fluctuations, which can be unsettling for investors. |

| 2. Tax advantages: Many countries offer tax advantages that shield investments from capital gains and income taxes. | 2. Behavioral challenges: Successful stock investing requires confidence and a long-term mindset to weather market downturns. |

| 3. Low costs: With platform and fund fees typically around 0.2%, equities offer a low-cost investment option. | 3. Intangibility: The intangible nature of stocks can be a psychological barrier for some investors. |

| 4. Diversification: Global equity funds allow for easy and effective diversification. | |

| 5. Liquidity: The ability to buy and sell shares quickly provides financial flexibility. |

In conclusion, investing in the stock market is characterized by high liquidity, easy diversification, and substantial long-term returns, making it a sound choice for those who are comfortable with market volatility and the intangible nature of stocks.

Let’s now shift our focus to the real estate market and examine its potential as an investment option. Understanding the pros and cons of real estate investments will provide a clearer picture of how they compare to stocks.

| Advantages of real estate investments | Disadvantages of real estate investments |

|---|---|

| 1. Steady income: Buy-to-let properties provide consistent rental income, acting as an inflation-linked bond. | 1. Maintenance Costs: Real estate requires ongoing maintenance and can incur significant costs from tenant damage and vacancies. |

| 2. Tangible asset: Real estate provides a physical presence that can be reassuring to investors. | 2. Management Effort: Managing a real estate portfolio can be time consuming, although outsourcing is an option. |

| 3. Leverage: Real estate investments can be leveraged to increase returns. | 3. Tenant issues: Problematic tenants can be a financial and emotional drain. |

| 4. Long-term mindset: The high transaction costs and difficulty in selling real estate encourage long-term investment. | 4. Illiquidity: Selling a property can take a long time, making it difficult to access invested capital quickly. |

| 5. Geographic concentration: Real estate investments are often concentrated in one geographic area, which increases risk. |

Real estate investments provide a steady stream of income and the security of a tangible asset, appealing to investors who prefer more physical investments despite higher maintenance costs and illiquidity. The ability to leverage real estate investments can enhance returns, but it also increases risk.

Historical Returns

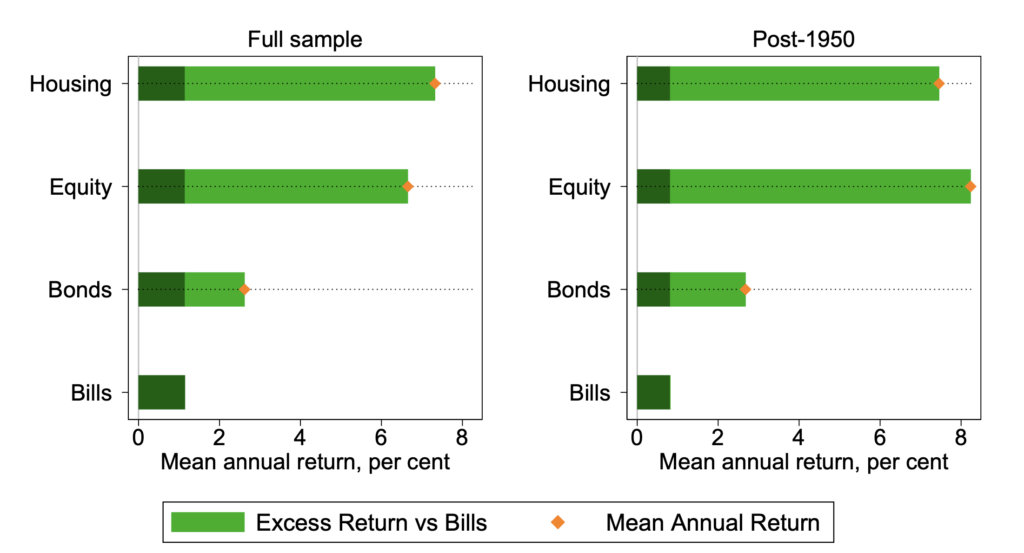

A study entitled “The Rate of Return on Everything from 1870 to 2015” provides a comprehensive comparison of equity and real estate investments. Historically, both asset classes have provided comparable total returns. However, since 1950, equities have generally outperformed property in the UK, delivering higher average returns.

Figure 1. Global real rates of return. Arithmetic avg. real returns p.a., unweighted, 16 countries. Consistent coverage within each country.

In order to provide a comprehensive comparison of equity and homeownership returns, the following table shows the historical performance of these investment options over different time periods and countries. This data provides valuable insight into long-term trends and regional variations in investment returns.

Table 1. Global real rates of return. Real rates of return on equity and housing. Average annual real returns. Period coverage varies between countries. Uniform coverage within countries. Average, unweighted and average, weighted figures are unweighted and real GDP-weighted arithmetic averages, respectively, of individual country returns.

| Country | Full Sample Equity | Full Sample Housing | Post 1950 Equity | Post 1950 Housing | Post 1980 Equity | Post 1980 Housing |

|---|---|---|---|---|---|---|

| Australia | 7.81 | 6.37 | 7.57 | 8.29 | 8.78 | 7.16 |

| Belgium | 6.23 | 7.89 | 9.65 | 8.14 | 11.49 | 7.20 |

| Denmark | 7.22 | 8.10 | 9.33 | 7.04 | 12.57 | 5.14 |

| Finland | 9.98 | 9.58 | 12.81 | 11.18 | 16.17 | 9.47 |

| France | 3.25 | 6.54 | 6.38 | 10.38 | 11.07 | 6.39 |

| Germany | 6.85 | 7.82 | 7.52 | 5.29 | 10.06 | 4.12 |

| Italy | 7.32 | 4.77 | 6.18 | 5.55 | 9.45 | 4.57 |

| Japan | 6.09 | 6.54 | 6.32 | 6.74 | 5.79 | 3.58 |

| Netherlands | 7.09 | 7.28 | 9.41 | 8.53 | 11.90 | 6.41 |

| Norway | 5.95 | 8.03 | 7.08 | 9.10 | 11.76 | 9.81 |

| Portugal | 4.37 | 6.31 | 4.70 | 6.01 | 8.34 | 7.15 |

| Spain | 5.46 | 5.21 | 7.11 | 5.83 | 11.00 | 4.62 |

| Sweden | 7.98 | 8.30 | 11.30 | 8.94 | 15.74 | 9.00 |

| Switzerland | 6.71 | 5.63 | 8.73 | 5.64 | 10.06 | 6.19 |

| UK | 7.20 | 5.36 | 9.22 | 6.57 | 9.34 | 6.81 |

| USA | 8.39 | 6.03 | 8.75 | 5.62 | 9.09 | 5.66 |

| Average, unweighted | 6.60 | 7.25 | 8.24 | 7.46 | 10.68 | 6.42 |

| Average, weighted | 7.04 | 7.25 | 8.13 | 6.34 | 8.98 | 5.39 |

As shown in the table, both equity and housing investments have shown varying degrees of performance depending on the country and time period.

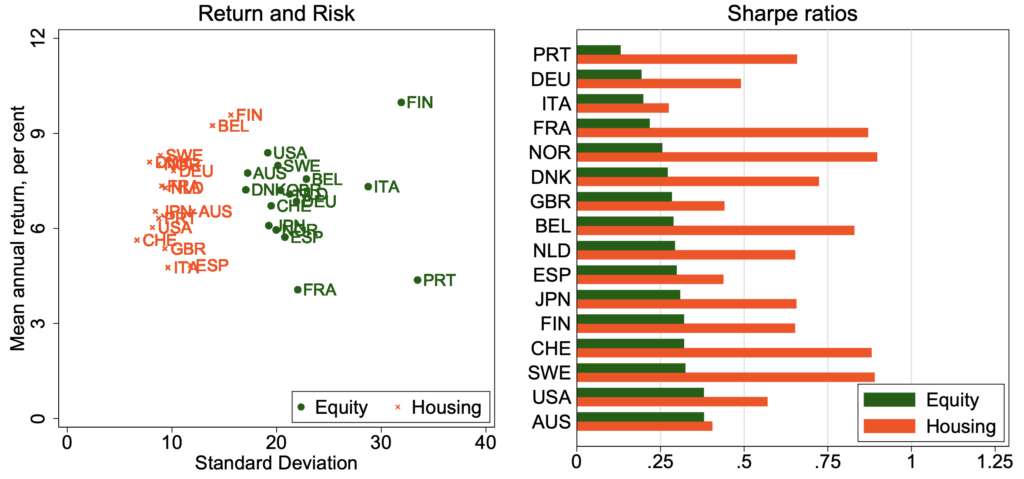

Risk-Adjusted Returns

The study also highlights that while equities have higher volatility, the low price update frequency of real estate can mask its underlying volatility. On a risk-adjusted basis, using measures such as the Sharpe ratio, real estate often appears more favorable due to its lower observed volatility.

Figure 2. Risk and Return of Equity and Housing. Left panel: Average annual real return and standard deviation. Right panel: Sharpe ratios for 16 countries.

Conclusion

The stock market has been characterized by higher long-term returns and less effort to maintain a diversified portfolio. However, the volatility and intangibility of the stock market may not be for everyone. Real estate investments offer steady income and the psychological comfort of tangible assets, but come with higher maintenance costs and illiquidity. Ultimately, the best investment choice depends on your risk tolerance, investment horizon and personal preferences. A balanced portfolio that includes both stocks and real estate can take advantage of the strengths of each asset class, providing diversification and stability. For researchers, there are many opportunities for in-depth analysis, particularly focusing on the behavioral aspects of investing in tangible versus intangible assets.

For more insights and updates on market trends and investment strategies, subscribe to our newsletter. Thanks for reading!